QQQ Anticipating Interest Rate Decision

Introduction As the Federal Reserve prepares to announce its latest interest rate decision, stakeholders in the Invesco QQQ Trust (QQQ), which tracks the NASDAQ-100, are closely monitoring potential impacts. Here’s a technical and contextual analysis to understand possible market reactions.

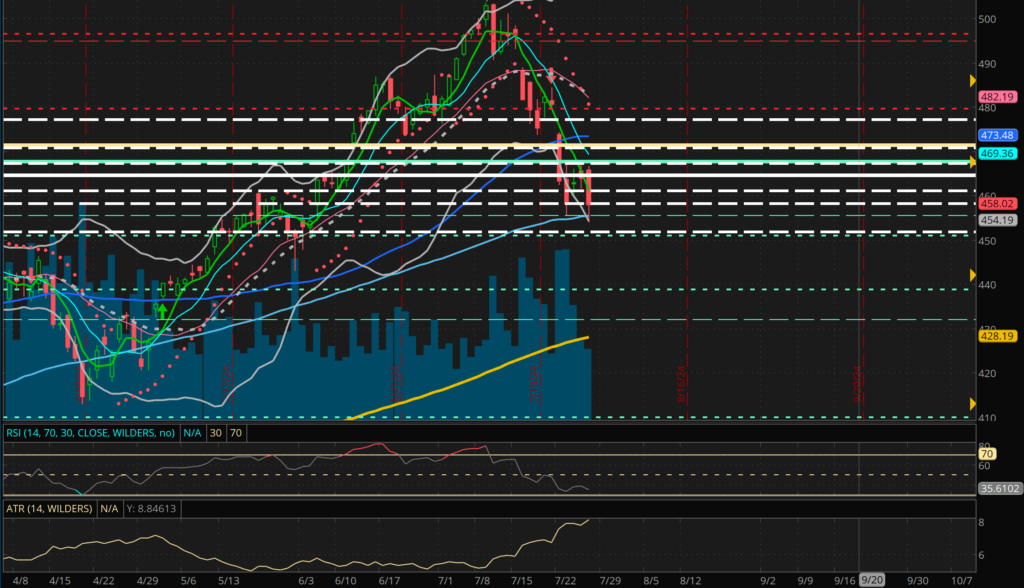

Current Technical Overview QQQ has shown resilience, hovering around $465, reflecting the robust performance of major tech stocks. Given the volatile economic climate, the ETF’s response to the interest rate decision could be pivotal.

Technical Indicators

- RSI (Relative Strength Index): Currently near 65, suggesting that QQQ is somewhat extended but not overwhelmingly overbought.

- MACD (Moving Average Convergence Divergence): The MACD line above the signal line indicates continuing bullish momentum, but the gap is narrowing, signaling that caution is warranted.

Impact of the Interest Rate Decision The interest rate decision could significantly influence QQQ, given its tech-heavy composition. Changes in rates affect tech stocks disproportionately due to their reliance on borrowing for growth and their sensitivity to discount rates used in valuation models.

Scenarios Post-Interest Rate Decision

- Moderate Bullish Scenario: A less aggressive rate hike or a dovish tone from the Fed could see QQQ testing upper resistance levels near $470-$475, reflecting relief and continued investor confidence in tech growth.

- Moderate Bearish Scenario: Conversely, a surprise rate increase or hawkish signals could pressure QQQ, potentially testing lower support levels at around $460-$455 as investors recalibrate their expectations for growth and borrowing costs.

Investors should prepare for volatility and have strategies ready to navigate both potential upswings and downturns. The exact movements of QQQ will depend on the nuances of the Fed’s announcements and subsequent market interpretations.

Advice: Stay vigilant and flexible. Adjust your investment strategies based on real-time economic indicators and market reactions. Diversification and protective stop-loss orders might be prudent in managing risks associated with the interest rate decision.